Summary

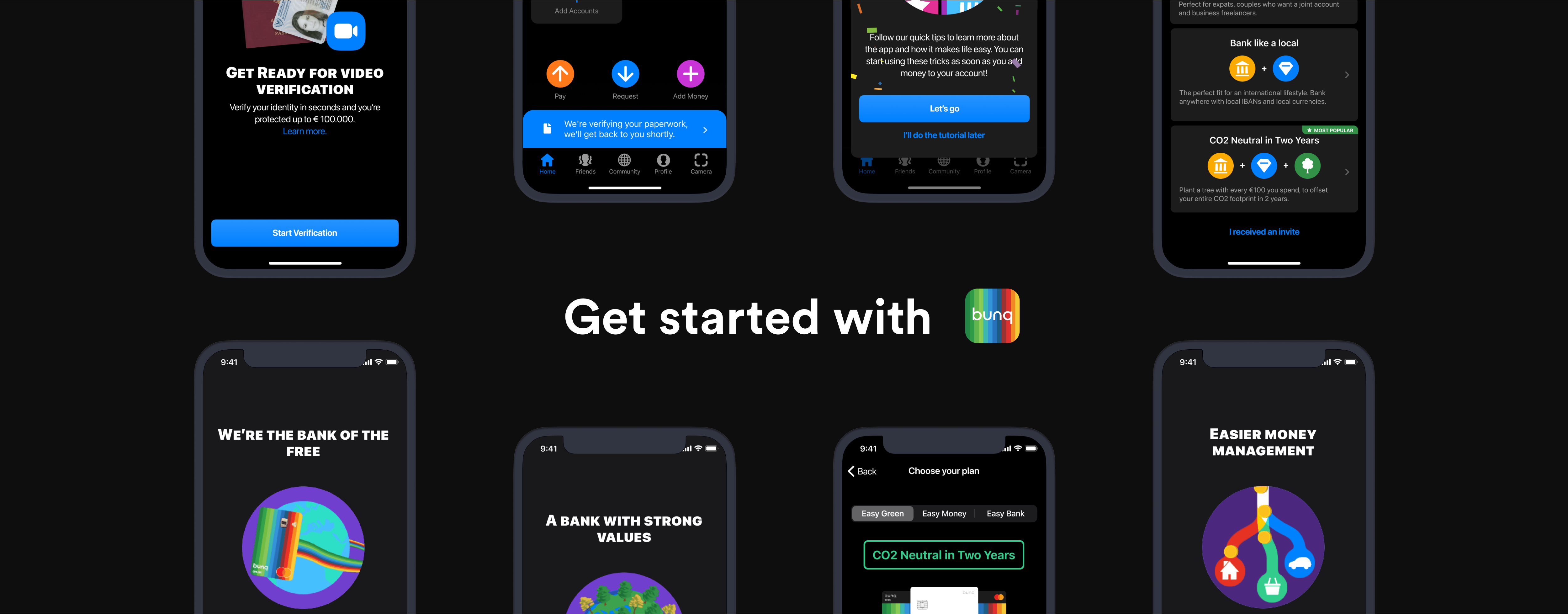

I led the design of the signup/onboarding experience for bunq to improve the conversion rate between several key steps.

Background & context

Onboarding users to a bank is never a straightforward experience, be it physical or online. At bunq, having always tried to "make life easy", this may have been another tradeoff that requires rethinking the signup experience through a specific customer persona.

Deliverables

- Gap Analysis on the current account creation experience

- A more engaging first interaction on app's first open

- Prototype of an onboarding flow increasing conversion by +10%

My role was being the product designer in the project, led by our Head of Data, Research, & Analytics and in collaboration with two software engineers and one product owner and two researchers.

Problem Statement

After focusing on making the signup easy, user conversion is dropping drastically over 3 months compared to the previous 3 months (even though task success rate improved considerably).

Research and Insights

Average time from current step for first app open to completing signup is significantly higher month on month, and easy setup duration increased considerably over the past 15 months.

After asking 10 users why would they drop-off during signup; 7 out of 10 mentioned that do not seeclear features when choosing a plan:

- “What is Easy Green? Um I'm not sure”

- “it didn't seem like it was showing features or prices”

- “I don’t understand what “open a bank account and 5 minutes” means and has to do here”

Conversion between App first open → First invoice paid

Exploration and design concept

We are conducted the following multivariate tests:

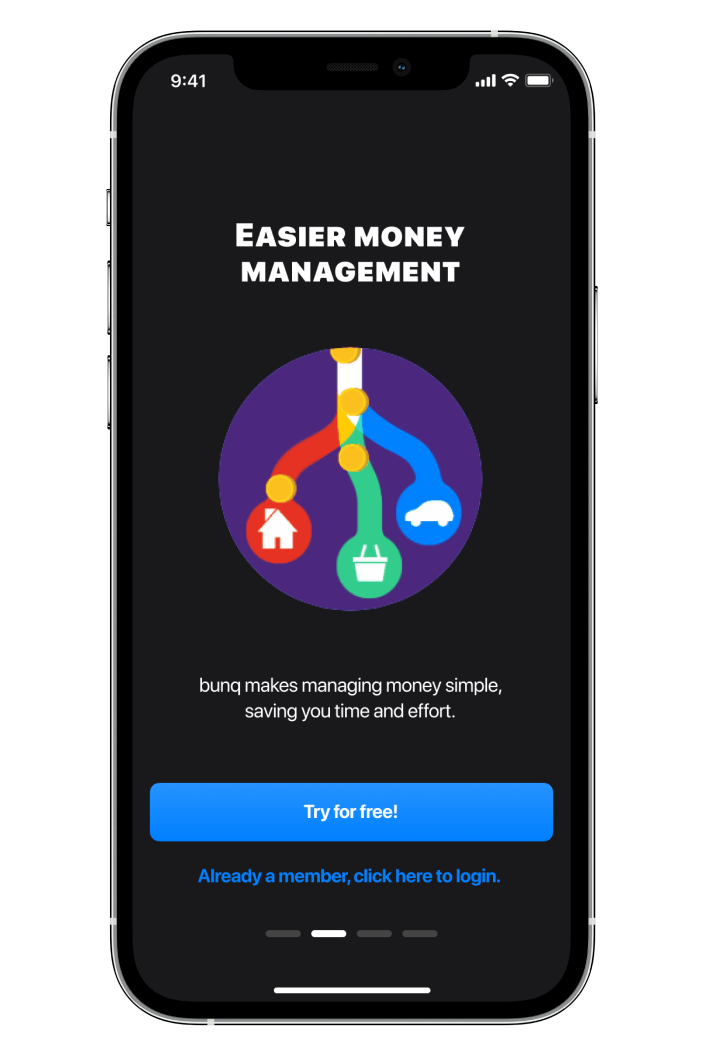

First 5 seconds

- A basic signup screen (Control experience)

- A static carousel

- An animated, auto-sliding carousels

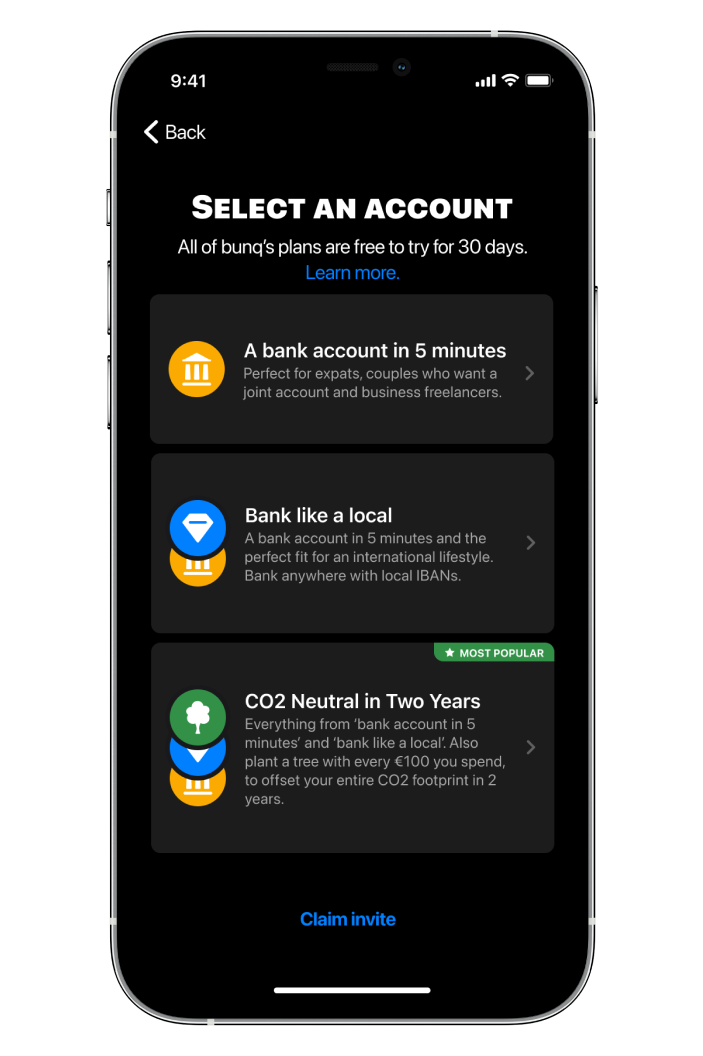

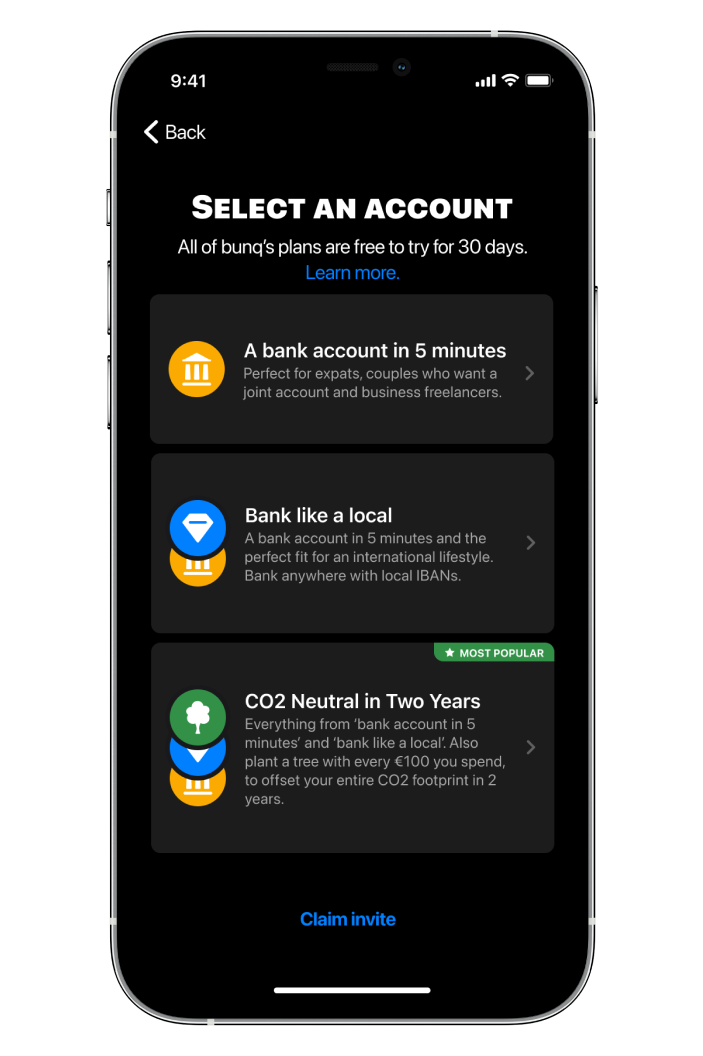

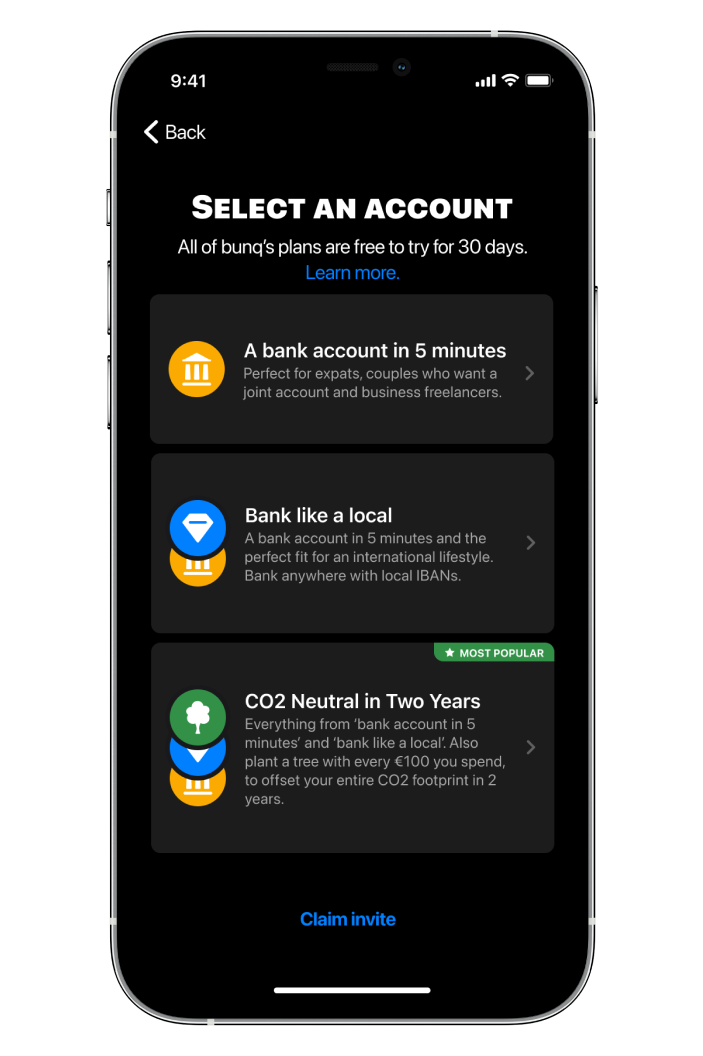

Selecting a Plan

- Trial first, decide after trial end (Control Experience)

- With a purpose

- With a comprehensive, fully detailed comparison

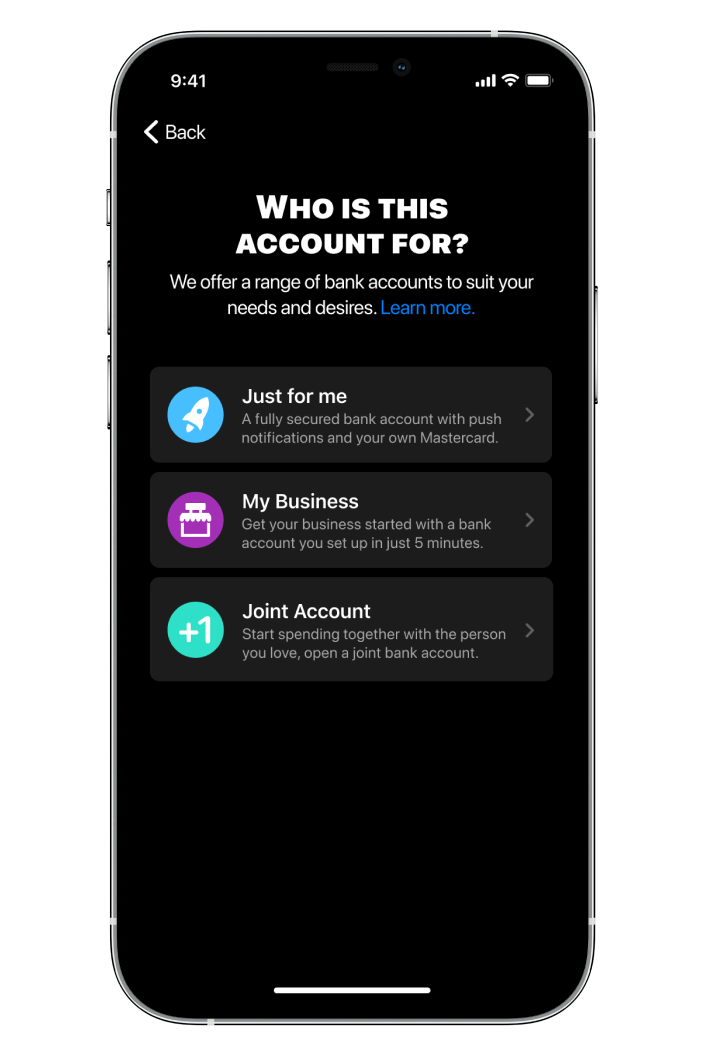

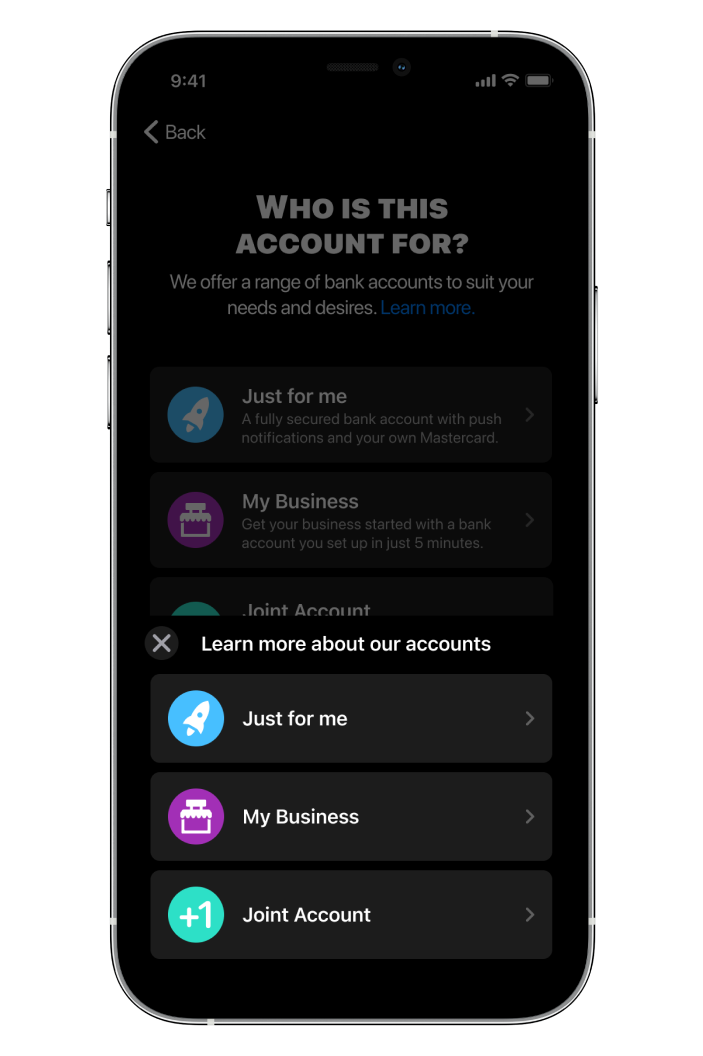

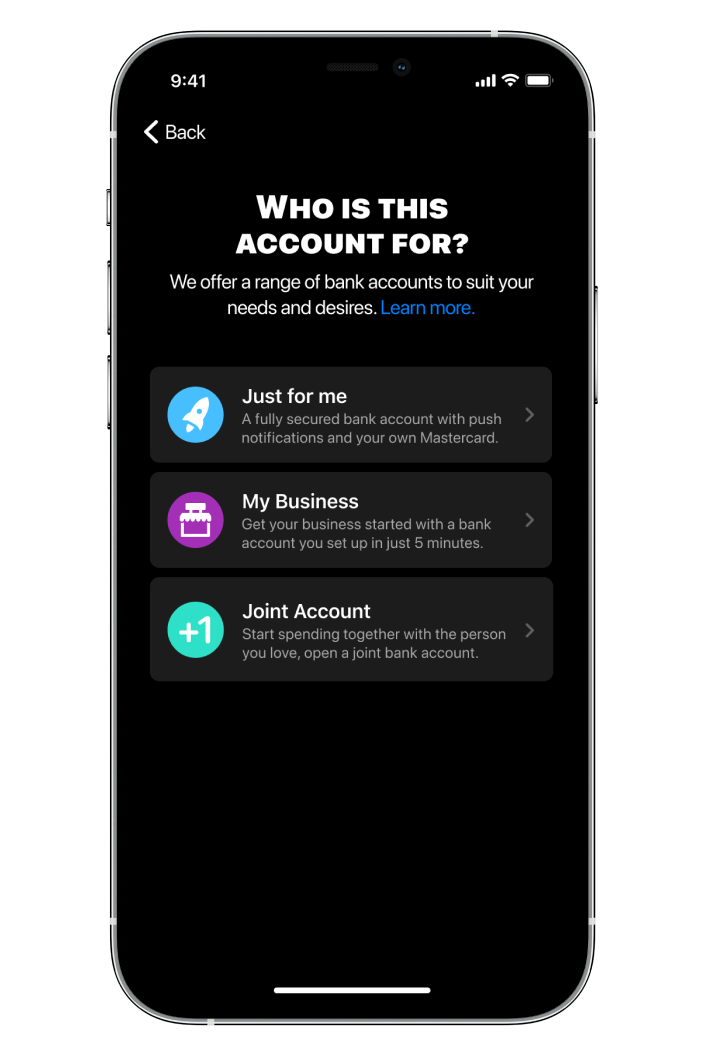

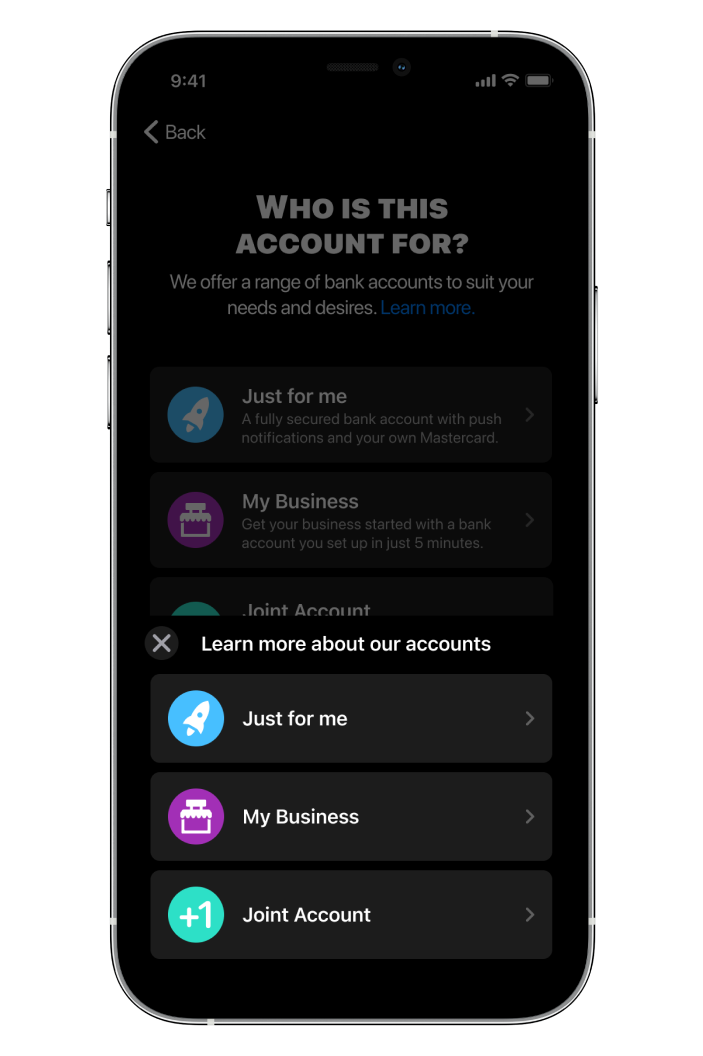

Selecting a type of account (Personal, Business, Joint)

- Skip it, users can add accounts later (Control Experience)

- Objective explanations (One interaction to choose, one to confirm)

- Subjective explanation (One interaction to directly choose)

Why did we choose these interactions? These interactions were related to the lowest conversion rates (weakest links) in the signup flows.

Testing and feedback

To make the design decisions, the results pointed to altering the following interactions/screens:

First Signup

Make an impression in the 1st 10 seconds

Plan choice

Help users pick their journey with purpose

Type of Account

Provide a thorough and adequate proposition to all users

1st month invoice

We use the first month to prove the value of bunq (cards, sub-accounts)

We chose our hypotheses based on a combination of qualitative testing (in-depth interviews), usability testing, and heuristics.

Results

Let's take the example of the plan choice flow: We ran usability testing for different variations of the signup process. We noticed that the user is dropping off during the onboarding process due to overwhelm and confusion.

We have run an A/B/C test with the current variants:

Variant A was the most converting (with 95% confidence), however gave the lesser amount of details. Variant B, though information-heavy, lead to users to feel less confident because the need to read more about the plans before choosing.

There are discrepancies in what users say and what they do, especially when choosing a plan, they like comparing, but the process is not necessarily clear or simple.

What users said

What users did

💬 “Detailed plans with features & pricing is good”

📱 Finished the process with the simpler plans much faster (2x or more)

💬 “Detailed plans with features & pricing is good”

📱 Finished the process with the simpler plans much faster (2x or more)

Solution

We filled the gaps in the user onboarding by pushing the following updates:

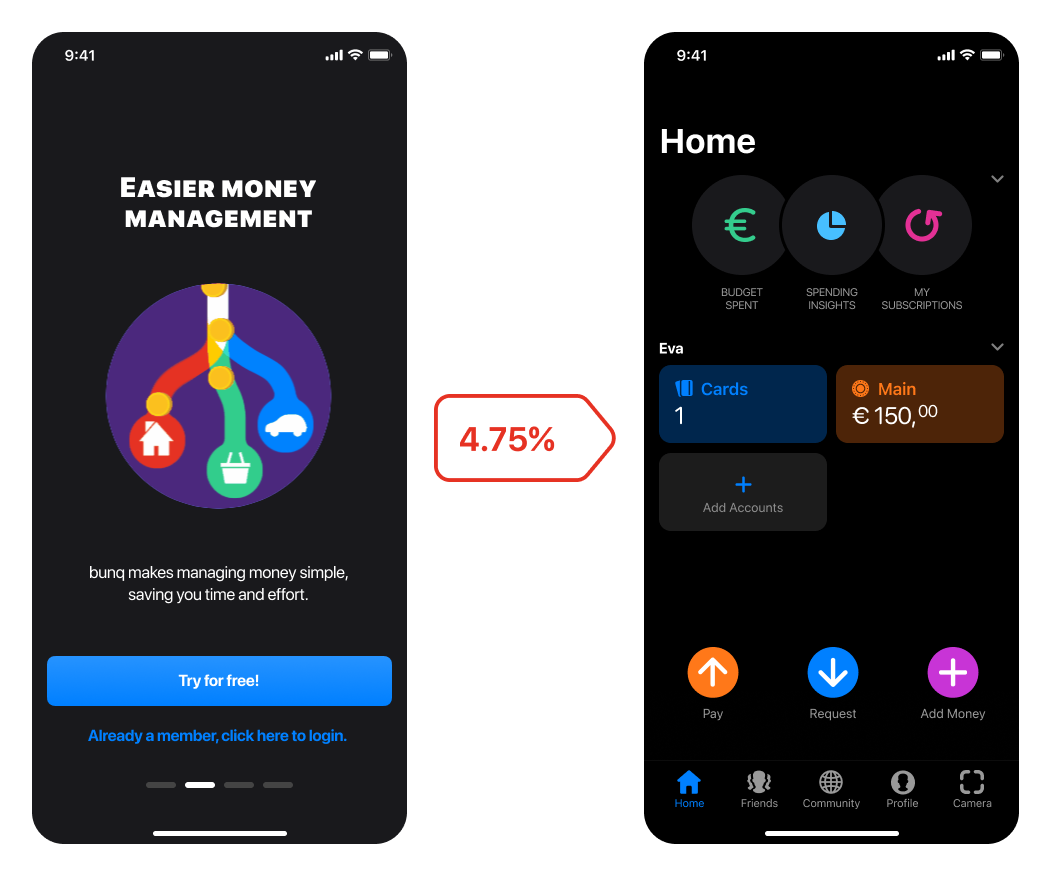

5 seconds or less to decide to give bunq a free trial

The first impression of the app should be a convincing pitch, focusing on the value proposition, but at the same time, enticing enough to start exploring.

Users have to understand what plan they choose

Users are given a purpose-based "deal" consideration where they choose what value they suits their needs.

Users are empowered to learn about all types of accounts

We walk users through what type of account they can get with bunq, by including a comparison experience.

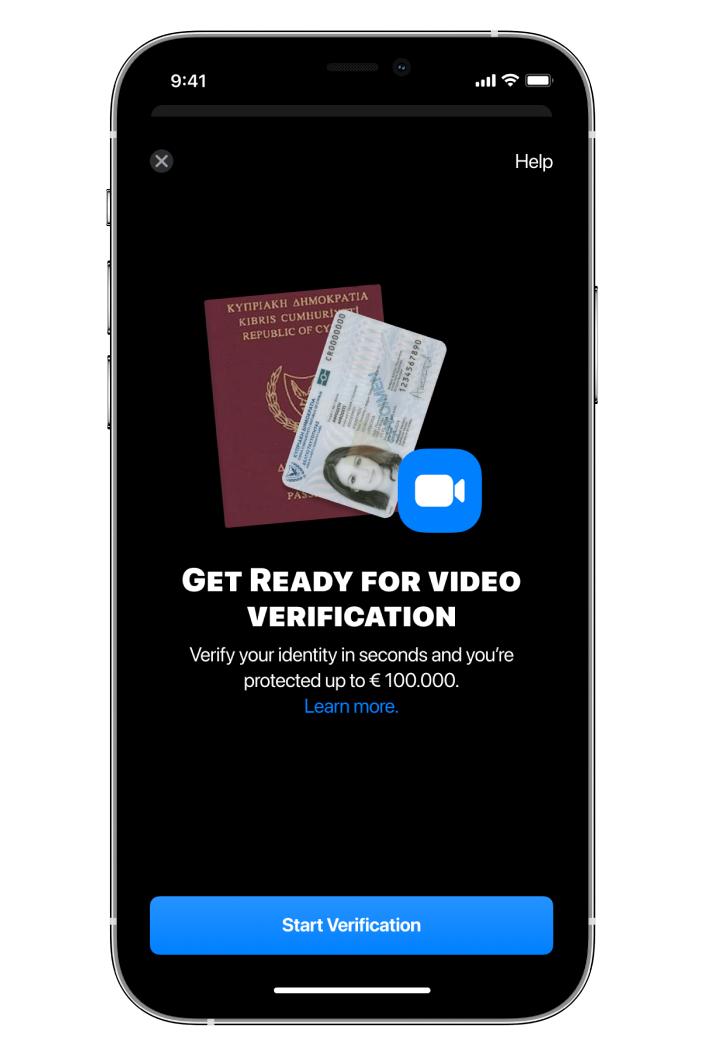

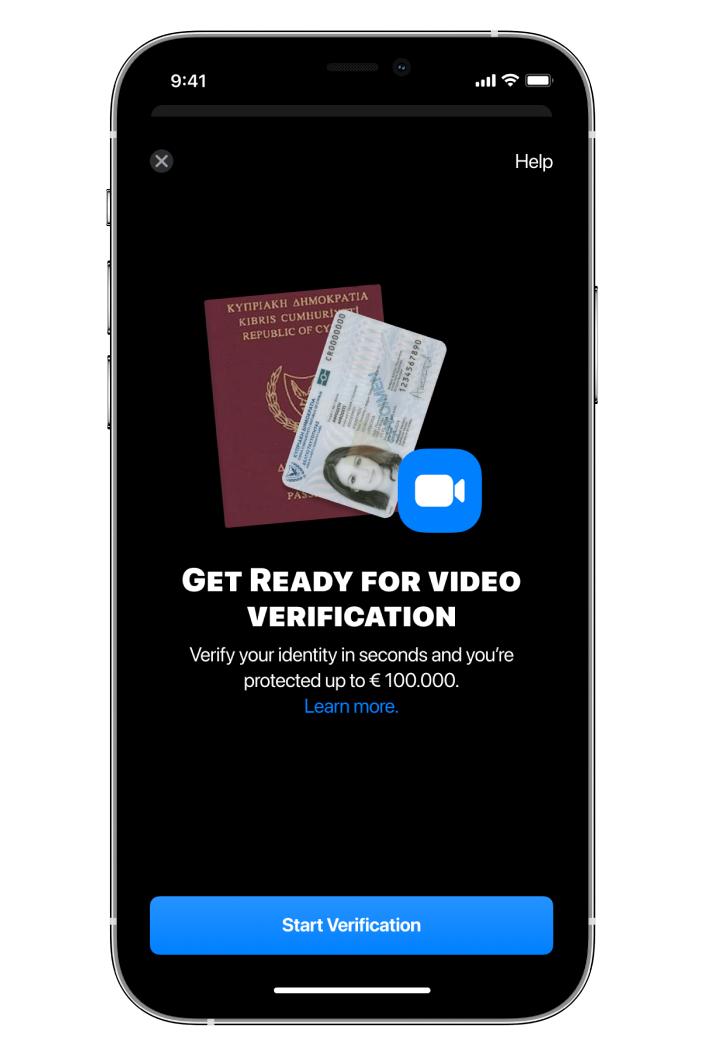

User re-verify conversion increase

We increased re-verification conversion from 29% to 44% by simply preparing users for the video verification phase, as well as providing a consideration (help, verification explanation) for possible frustrations with repeated experiences.

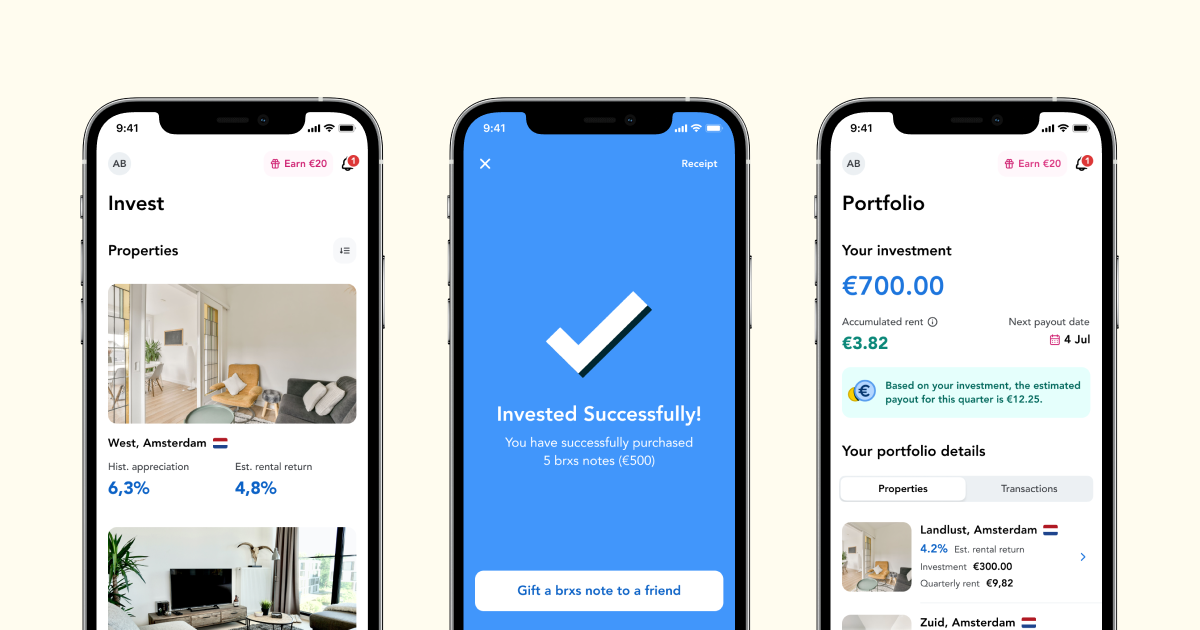

User activation (i.e. from verified to 1st invoice)

Giving tutorials to the prompt actions highly correlated with retention, increased long-term conversion of our paying customers.